Tax Resolution Resources

I have a passion for helping anyone who has been affected by tax problems, not just my clients. These free tax resolution resources are meant to educate and inform anyone who wants to increase their knowledge of tax relief.

Guest Expert

Patricia Gentile is a regular guest expert on the Frankie Boyer Show, a nationally syndicated show on BizTalk Radio heard coast-to-coast. Patricia’s information-loaded interviews offer IRS and tax information every taxpayer needs. Here are a few shows:

FEATURED PODCAST

Pat Gentile on IRS Tax Relief Options

Patricia Gentile / Frankie Boyer Interview

Episodes

Podcast Update

Segment on WGCH Morning News Center

irs and tax scams

Segment on WADK Newport

3 forms to know for tax season

Segment on News Talk AM1490 WGCH Morning News Center

EPISODE 1

Pat Gentile Frankie Boyer Interview

EPISODE 2

Pat Gentile Frankie Boyer Interview

EPISODE 3

Pat Gentile Frankie Boyer Interview

EPISODE 4

Pat Gentile Frankie Boyer Interview

EPISODE 5

Pat Gentile Frankie Boyer Interview

EPISODE 6

Pat Gentile Frankie Boyer Interview

EPISODE 7

Pat Gentile Frankie Boyer Interview

EPISODE 8

Pat Gentile Frankie Boyer Interview

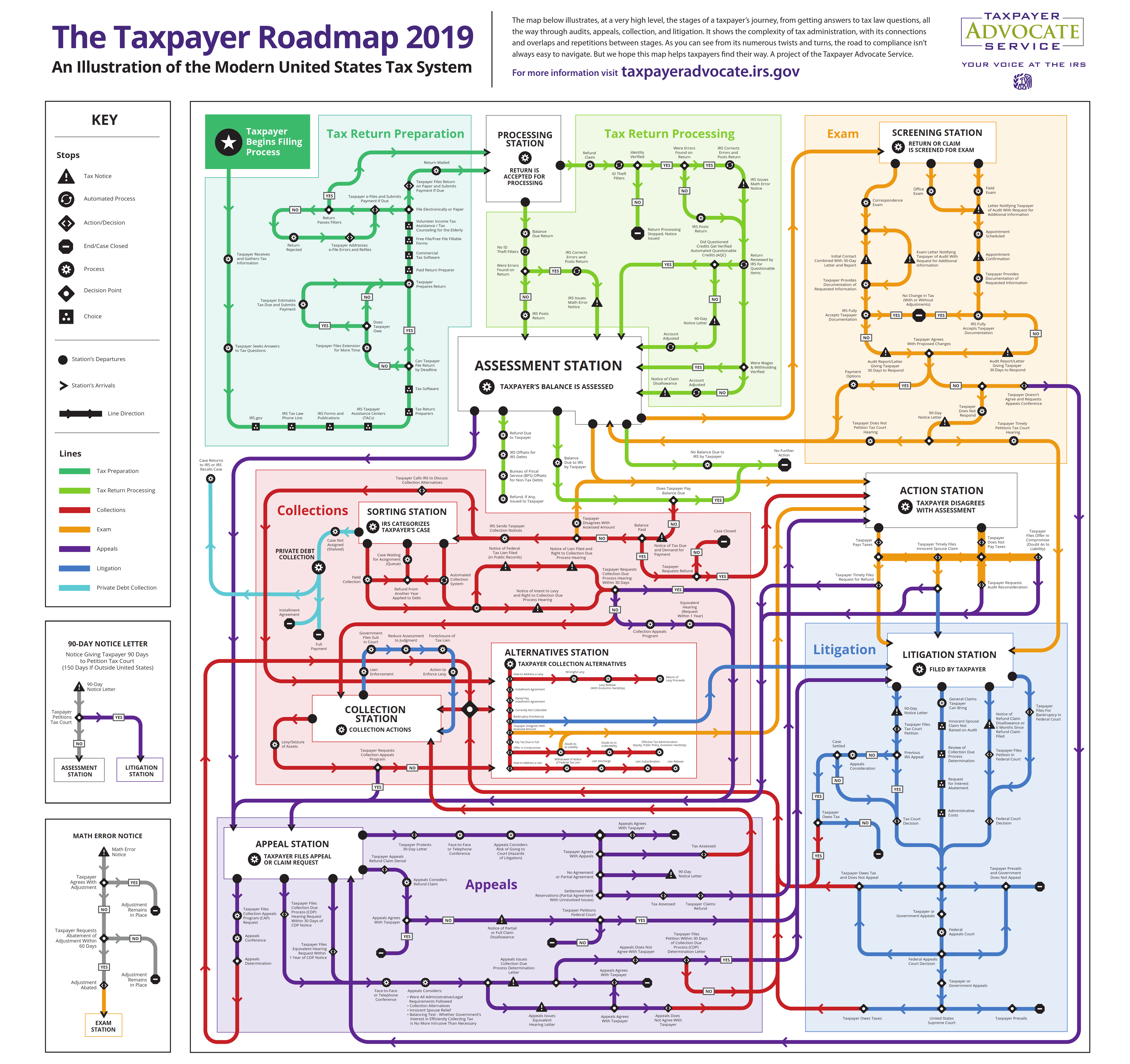

The Taxpayer Roadmap, a project of the Taxpayer Advocate Service, illustrates the stages of a taxpayer's journey, from getting answers to tax law questions, all the way through audits, appeals, collection, and litigation and shows the complexity of tax administration, with its connections and overlaps and repetitions between stages. This tax resolution resource was created to help tax payers find their way and plan wisely.

From the Blog Archives

Gig Workers on the Radar: How On Demand Workers Can Reduce Their IRS Audit Risk

September 27, 2023

As the shift from traditional employment to self-employment and business ownership continues, many workers are finding themselves in a brand new situation. The IRS has noticed the shift to gig work,…

Tax Scams You Should Be Aware of That Could Get You In Trouble With The IRS

September 27, 2023

Tax filing season is a source of stress for just about everyone. That extra stress and uncertainty ramps up and up, and you never know if you must write a check to the IRS. You also do not know which…

Consulting Member and Advisory Board Member, Taxpayers Defense Institute, Inc., Stillwater, MN

Daughter of the American Revolution

Member, Massachusetts Bar Association

Juris Doctor, Massachusetts School of Law, Andover, MA

Mediation Training Program, Mediation Works Incorporate, Boston MA

7 Secrets the IRS Doesn't Want You to Know

Every IRS situation is unique yet there IS valuable information about your taxpayer rights that you need to know, sooner than later. Often, this missing or inaccurate information is what you need to make an informed, proactive decision to solve your IRS problem… once and for all.

I want to evaluate your unique situation. Take action today to schedule your free, one-on-one phone consultation with me. I will be back in touch with you within 24-48 hours:

Call me today at 1-800-880-8388, or complete the form below.

You can download my book now or after we speak! Either way, it is free to you today!